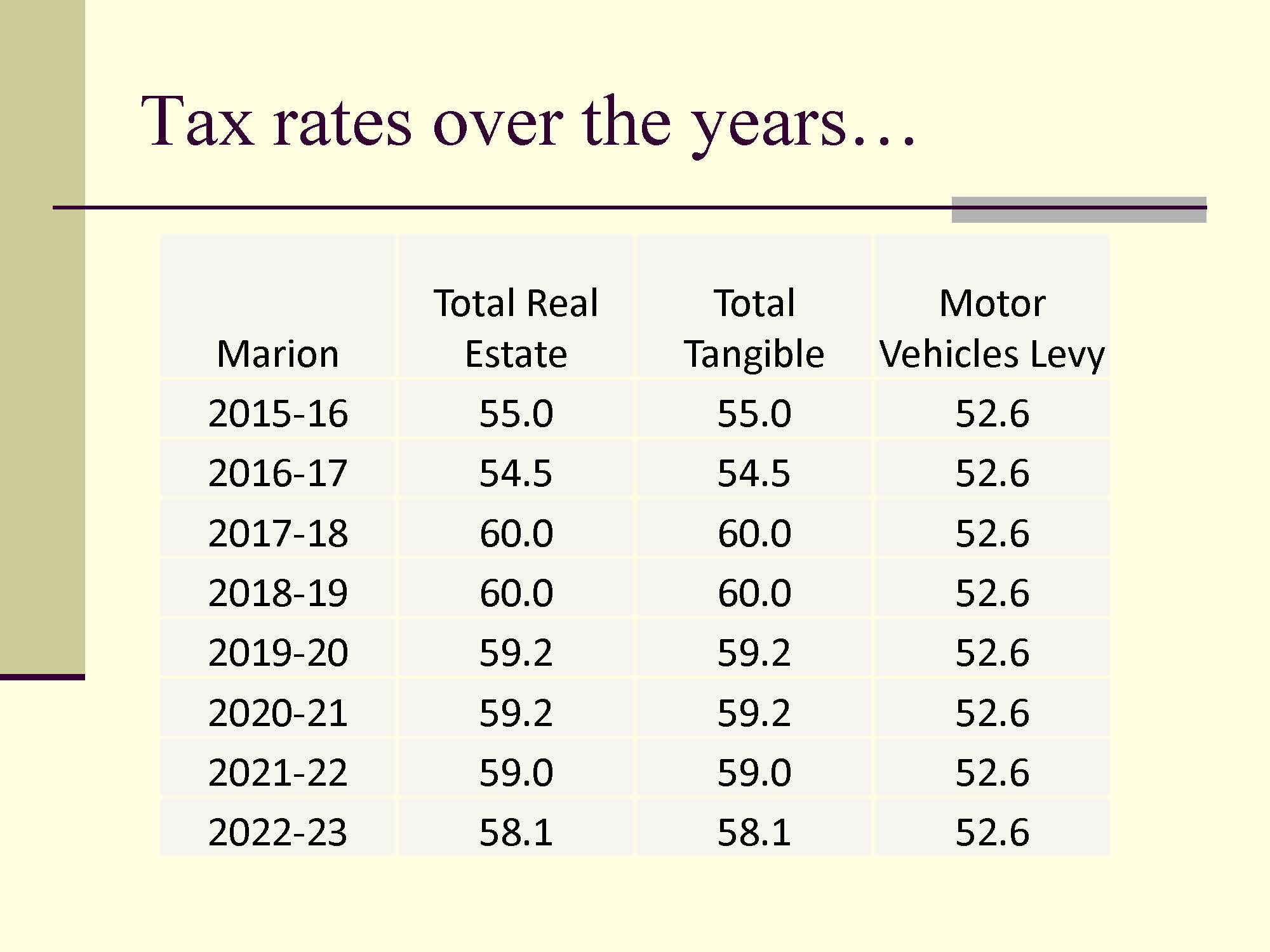

Marion County residents will get the best of both worlds with the recently approved tax rate: a lower rate and more revenue for the public school district.

The Marion County Board of Education voted to lower the property tax rate to 57.7 cents per $100 of property at its Special Called meeting Monday, August 21. The rate previously sat at 58.1 cents. The vehicle property tax remained at 52.6 cents.

The lowered tax rate will produce a four percent increase in revenue that translates to over $410,000, which Superintendent Chris Brady says will help the district continue to operate productively.

“We made a significant investment in our teachers and staff recently when we revamped our salary schedule to make ourselves more competitive in the job market,” Brady said. “This four percent increase means we can continue to make MCPS a great place to work and learn, all while lowering the tax rate for our community.”

The school district has been able to lower the tax rate and still see an increase in revenue multiple times in recent years due to increased property assessments.

The increased revenue for the school district is especially important given the passage of HB5 which will sunset the Distilled Spirits tax over the next two decades. While MCPS won’t immediately feel the effects of the removal of the Distilled Spirits tax, it will eventually result in the school district losing out on millions every year.

The Board of Education held a tax hearing which allowed for public comment directly followed by a Special Called meeting where the board approved the tax rate.

You can view a recording of both the tax hearing and the Special Called meeting on the district’s YouTube channel at the link below.

VIDEO: Board of Education Tax Hearing and Special Called meeting